Ypsilanti Chapter 7 Lawyer

One of the Best Bankruptcy Attorneys in Ann Arbor/Ypsilanti, MI

Office Location

2498 Washtenaw Avenue

Ypsilanti, MI 48197

Monday – Friday : 9:00 am – 5:00 pm

Saturdays : 9:30am – 11:30 by phone only

Ann Arbor offers in office appointments as late as 6:30 on Wednesday, but offers over phone late night appointments Mon-Thur

Highly Recommended

Get a Free Consultation

Ypsilanti Chapter 7 Attorney

Our Ypsilanti Chapter 7 attorneys can help. Call (734) 213-2599 today to schedule a free consultation and take the first step towards a debt-free future.

Frego & Associates has been the largest bankruptcy law firm in Michigan since 1999. Our Chapter 7 lawyers are specialists in consumer bankruptcy and can walk you through the process from start to finish.

Don’t wait any longer to get the help you need.

Reasons to File Chapter 7 Bankruptcy in Ypsilanti

- Get a fresh start: Chapter 7 bankruptcy provides you with a fresh start by wiping out most of your unsecured debts. This includes credit card bills, medical bills, personal loans, and more. Once these debts are discharged, you can start rebuilding your credit and working towards a more stable financial future.

- Stop creditor harassment: The moment you file for Chapter 7 bankruptcy, an automatic stay is put in place, which prohibits creditors from contacting you or pursuing any collection actions. This means no more irritating phone calls, letters, or wage garnishments. It gives you a much-needed break from the constant stress of dealing with debt collectors.

- Protect your assets: Contrary to popular belief, filing Chapter 7 bankruptcy does not mean losing all your belongings. Each state has exemptions that allow you to protect certain assets, such as your home, car, personal belongings, and retirement accounts.

- Quick process: Compared to other bankruptcy chapters, Chapter 7 bankruptcy is relatively quick. Typically, the whole process takes about three to six months.

- No repayment plan: Unlike Chapter 13 bankruptcy, which requires you to create a repayment plan to pay off your debts over three to five years, Chapter 7 bankruptcy does not involve a repayment plan. Once your debts are discharged, you are not required to make any further payments towards these discharged debts.

- Credit score recovery: Although filing for bankruptcy will initially impact your credit score negatively, it allows you to start anew. With time and responsible financial practices, you can slowly rebuild your credit score. Many people find that their credit scores actually improve after filing for Chapter 7 bankruptcy because they are no longer burdened by overwhelming debt.

According to statistics released by the Administrative Office of the U.S. Courts, annual bankruptcy filings totaled 418,724 in the year ending June 2023, compared with 380,634 cases in the previous year. [1]

Do I Qualify to File Chapter 7?

This type of bankruptcy is designed to help individuals and businesses eliminate most of their unsecured debts and start anew. Not everyone qualifies for Chapter 7 bankruptcy; there are certain requirements that must be met.

One of the key criteria for filing Chapter 7 bankruptcy is passing the means test. This test compares your average monthly income for the six months prior to filing with the median income in your state. If your income falls below the median income, you are automatically eligible to file Chapter 7 bankruptcy.

On the other hand, if your income exceeds the median income, your eligibility will depend on various factors, including your disposable income and the amount of your debts.

Another important factor in determining your eligibility is the type of debt you have. Chapter 7 bankruptcy primarily deals with unsecured debts, such as credit card bills, medical bills, and personal loans.

Secured debts, such as mortgages and car loans, are typically not eliminated through Chapter 7 bankruptcy. Filing for Chapter 7 bankruptcy can still provide some relief by eliminating your unsecured debts, which may free up funds to help you meet your secured debt obligations.

Before you can file for Chapter 7 bankruptcy, it’s important to receive credit counseling from an approved agency within 180 days prior to filing.

This counseling session is designed to evaluate your financial situation and explore alternative options to bankruptcy.

Have all the necessary documentation in order, including income statements, tax returns, lists of assets and liabilities, and a detailed breakdown of your monthly expenses.

In 2019, Chapter 7 filings accounted for 62% of total filings, while Chapter 13 filings accounted for the remaining 38%. [2]

According to Epiq’s data, there were over 200,000 total bankruptcy filings nationwide in the first six months of this year, up 17% from the more than 185,000 total filings during the same period last year. [3]

What Exemptions Are Available for Those Filing Chapter 7?

Exemptions are designed to provide individuals filing Chapter 7 with a fresh start while still preserving some of their necessary possessions.

Common types of exemptions include homestead exemptions, which protect the equity in your primary residence up to a certain value. This means that you may be able to keep your home and continue making mortgage payments even after filing for bankruptcy.

There may be exemptions for vehicles, personal property such as furniture and appliances, retirement accounts, tools of trade, and even certain public benefits like Social Security or unemployment benefits.

By utilizing exemptions effectively, you can protect the assets that are most important to you and ensure that you have a solid foundation to rebuild your financial life.

Exemptions available in Chapter 7 bankruptcy are different from those in Chapter 13 bankruptcy.

If you are considering filing for bankruptcy, discuss your options with one of our Ypsilanti bankruptcy attorneys.

Ninety-seven percent of all bankruptcies in America are filed for individual debt. [4]

What You Should Do Before Filing Chapter 7 in Ypsilanti?

- Assess Your Financial Situation: Take a close look at your financial position and evaluate your debts, assets, and income. Determine the types of debt you have, whether they are secured or unsecured, and the total amount owed.

- Explore Alternatives to Bankruptcy: Bankruptcy should be considered as a last resort. Before filing, explore other options that may be available to you, such as debt consolidation, debt settlement, or negotiating with creditors.

- Consult with our Bankruptcy Attorney: We will provide you with expert guidance, help you understand the pros and cons of bankruptcy, and assist you in navigating the complex legal process.

-

Gather Your Financial Documents: Before filing for bankruptcy, make sure to gather all relevant financial documents, including tax returns, bank statements, pay stubs, and any documentation related to your debts and assets.

These documents will be required during the bankruptcy process and will help provide a clear picture of your financial situation. - Attend Credit Counseling: Individuals are required to receive credit counseling from an approved agency within 180 days before filing for bankruptcy. This counseling will help you understand the implications of bankruptcy and explore alternatives to bankruptcy.

- Stop Using Credit: Once you have made the decision to file for bankruptcy, it's important to stop using credit immediately. Continuing to accumulate debt will only complicate your bankruptcy case and may even be considered fraudulent activity.

- Prepare for the Meeting of Creditors: As part of the bankruptcy process, you will be required to attend a meeting of creditors. This meeting provides an opportunity for your creditors to ask questions about your financial situation. Your bankruptcy attorney will guide you on how to prepare for this meeting.

The Benefits of Hiring a Chapter 7 Lawyer in Ann Arbor/Ypsilanti

From evaluating your financial situation to completing the necessary paperwork and representing you in court, our skilled Chapter 7 attorneys will ensure that your rights are protected and that you receive the full benefits of filing for bankruptcy.

Another advantage of working with a Chapter 7 lawyer is our ability to handle communications with creditors on your behalf. Once you file for bankruptcy, an automatic stay is put in place, which prohibits creditors from taking any further collection actions against you.

Your experienced bankruptcy attorney will handle all correspondence, negotiations, and disputes with creditors, relieving you of the stress and harassment associated with collection activities.

Hiring our bankruptcy lawyer in Ann Arbor/Ypsilanti gives you peace of mind during a financially challenging time. Bankruptcy can be emotionally overwhelming, and having an attorney who understands your specific circumstances and works tirelessly on your behalf can alleviate some of the stress.

We will provide you with personalized attention, answer any questions you have, and provide honest and practical advice throughout the process.

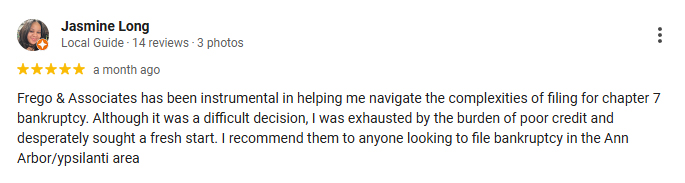

What Our Clients Are Saying About Us - Client Reviews

Are You Drowning In Debt With No Way Out? It’s Time to Take Control of Your Financial Future.

Contact Frego Law today to schedule your free consultation and take the first step towards a debt-free life. Let our Chapter 7 attorney guide you through the bankruptcy process and provide the legal representation you deserve. Don’t wait any longer; take control of your financial future now.

Sources:

[1] Bankruptcy Filings Rise 10 Percent. (2023, July 31). United States Courts. https://www.uscourts.gov/news/2023/07/31/bankruptcy-filings-rise-10-percent

[2] Gupta, R. (2023, March 24). Personal Bankruptcy Statistics for 2023: States, Causes & Cost. FinMasters. https://finmasters.com/personal-bankruptcy-statistics/

[3] Dumas, B. (2023, July 7). US bankruptcy filings surge in first half of 2023. Fox Business. https://www.foxbusiness.com/economy/us-bankruptcy-filings-surge-first-half-2023

[4] Just the Facts: Consumer Bankruptcy Filings, 2006-2017. (2018, March 7). United States Courts. https://www.uscourts.gov/news/2018/03/07/just-facts-consumer-bankruptcy-filings-2006-2017

Received Accolades:

206-2010, 2012, 2014-2021

American Bankruptcy Institute

Certified as a Bankruptcy Specialist by ABC

National Association of Consumer Bankruptcy Attorneys

Better Business Bureau

Office Location

2498 Washtenaw Avenue

Ypsilanti, MI 48197

Monday – Friday : 9:00 am – 5:00 pm

Saturdays : 9:30am – 11:30 by phone only

Ann Arbor offers in office appointments as late as 6:30 on Wednesday, but offers over phone late night appointments Mon-Thur