Warren Chapter 13 Bankruptcy Attorney

One of the Best Bankruptcy Attorneys in Warren, MI

Office Location

30800 Van Dyke Ave

Warren, MI 48093

Monday – Friday : 9:00 am – 5:00 pm

Saturdays : 9:30am – 11:30 by phone only

In office appointments as late as 6:30 on Wednesday. We offer over phone late night appointments Mon-Thur

Highly Recommended

Get a Free Consultation

Warren Chapter 13 Bankruptcy Attorney

Look no further than Frego Law, your trusted Chapter 13 lawyer in Warren, Michigan. We understand Chapter 13 bankruptcy law and are here to guide you through the process of filing with compassion and expertise.

Don’t let your debt hold you back any longer. Call Frego Law today and take the first step towards a brighter tomorrow. Schedule your initial consultation now.

Definition of Chapter 13 Bankruptcy

Chapter 13 bankruptcy is a legal process designed to help individuals restructure their debts and create a manageable repayment plan. It allows debtors to keep their assets while repaying a portion or all of their outstanding debt over a three to five-year period.

One of the main benefits of filing for Chapter 13 bankruptcy is the ability to protect valuable assets, such as a home or car, from being seized by creditors. Through a court-approved repayment plan, individuals can propose to repay their debts based on their disposable income and ability to pay.

In a Chapter 13 bankruptcy case, debtors work closely with our experienced bankruptcy attorneys to create a repayment plan tailored to their financial situation. The plan outlines the frequency and amount of monthly payments that the debtor will make to a trustee, who then distributes the funds to creditors. This allows debtors to make affordable payments and avoids the need to liquidate assets.

Chapter 13 bankruptcy is particularly beneficial for individuals with a steady income but who are struggling to meet their financial obligations. By restructuring their debts, individuals can catch up on missed mortgage or car payments, stop foreclosure or repossession proceedings, and regain control of their financial affairs.

Some debts, such as child support, alimony, student loans, and certain tax obligations, cannot be discharged through Chapter 13 bankruptcy.

To file for Chapter 13 bankruptcy, individuals must pay a filing fee and submit a bankruptcy petition along with supporting documentation to the bankruptcy court. They are also required to attend a meeting of creditors, where a bankruptcy trustee reviews the proposed repayment plan and addresses any concerns or questions.

Do I Qualify for a Chapter 13 Bankruptcy in Warren, MI?

One of the key factors is having a regular income that allows you to make monthly payments towards your debts. This is because Chapter 13 bankruptcy involves creating a court-approved repayment plan based on your disposable income.

Disposable income is the amount of money you have left over after paying your necessary expenses, such as rent or mortgage, utilities, and groceries. This income is then used to make monthly payments to a bankruptcy trustee who distributes the funds to your creditors.

Another requirement is that your unsecured debts cannot exceed a certain limit. Unsecured debts include credit card debts, medical bills, and personal loans that are not backed by collateral. If your unsecured debts exceed this threshold, you may not be eligible for Chapter 13 bankruptcy. There is a separate limit on secured debts that must be considered.

To qualify for Chapter 13 bankruptcy, you must not have filed for bankruptcy in the previous two years for Chapter 7 or the previous four years for Chapter 13. This is to prevent individuals from abusing the bankruptcy system.

Chapter 13 filings increased 30.9 percent, from 120,002 to 157,087 in the year ending Dec. 31, 2022. [1]

What You Should Do Before Filing a Warren Chapter 13 Bankruptcy

- Evaluate your financial situation: Before proceeding with bankruptcy, take a thorough look at your finances. Calculate your total outstanding debt, including secured and unsecured debts. Assess your monthly income and expenses to determine your disposable income.

- Explore alternative debt relief options: Bankruptcy should be a last resort. Consider alternative options such as debt consolidation, negotiation with creditors, or credit counseling.

- Consult with our bankruptcy attorney: We can analyze your financial situation, provide advice on whether bankruptcy is the right choice for you, and guide you through the entire process.

- Gather required documents: Before filing for bankruptcy, you will need to gather several documents. These may include tax returns, pay stubs, bank statements, and a list of your assets and liabilities.

- Attend credit counseling: Under bankruptcy law, individuals must participate in credit counseling from a court-approved agency within 180 days before filing. This counseling session will help you understand your financial situation better, explore alternative debt relief options, and determine if bankruptcy is the right choice for you.

- Understand the implications of Chapter 13 bankruptcy: Before filing, it's essential to understand the impact that Chapter 13 bankruptcy will have on your financial future. It will remain on your credit report for seven years, making it challenging to obtain credit in the future. You will be required to follow a court-approved repayment plan for a specific period, typically three to five years.

- Consider the costs involved: Filing for bankruptcy incurs certain costs, including filing fees, attorney fees, and credit counseling fees. Make sure you understand these costs and factor them into your decision-making process.

Medical debt is the leading cause of bankruptcy in the US. In 2020, 66.5% of bankruptcies were filed due to medical debt. [2]

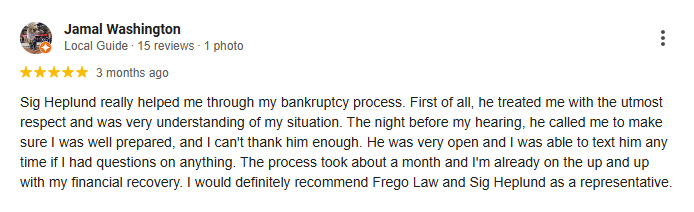

What Our Clients Are Saying About Us - Client Reviews

Benefits of Working With a Warren Chapter 13 Lawyer

Experience and Expertise: Our Chapter 13 lawyers in Warren, Michigan, specialize in bankruptcy cases and have extensive experience dealing with the complexities of Chapter 13 filings. We understand the intricacies of bankruptcy law, court procedures, and how to navigate through the process efficiently.

Personalized Advice: Every bankruptcy case is different, and what works for one individual may not be applicable to another. Our Chapter 13 lawyers will thoroughly analyze your financial situation, assess your outstanding debts, and help you determine whether Chapter 13 bankruptcy is the right choice for you.

We will provide personalized advice based on your unique circumstances, ensuring that you make an informed decision about your financial future.

Representation and Advocacy: Filing for Chapter 13 bankruptcy involves multiple court appearances and interactions with creditors and the bankruptcy trustee.

Having our Chapter 13 lawyers by your side ensures that you have proper representation and advocacy throughout the entire process. We will communicate and negotiate with creditors on your behalf and make sure your rights are protected during the meeting of creditors and other essential hearings.

Preparation and Documentation: Our Chapter 13 lawyers will assist you in gathering and organizing all the necessary paperwork, ensuring that you meet all the legal requirements and deadlines.

Debt Restructuring and Repayment Plan: We will work closely with you to develop a payment plan and propose it to the court. We will ensure that the plan takes into account all your debts, including secured and unsecured ones, and helps you regain control of your financial situation effectively.

Protection from Creditors: Once you file for Chapter 13 bankruptcy, an automatic stay goes into effect, which prohibits creditors from taking any collection actions against you.

This means that creditors cannot continue with threatening phone calls, wage garnishments, or lawsuits.

Our firm will provide this protection and act as a shield between you and your creditors, giving you the peace of mind and the breathing space necessary to focus on your financial recovery.

Are You Feeling Overwhelmed by Debt and Looking for a Way to Regain Control of Your Financial Situation?

Filing for Chapter 13 bankruptcy can provide you with a fresh start and a chance to reorganize your debts into an affordable repayment plan. With Frego Law by your side, you can regain control of your finances and start building a brighter future.

Contact our experienced bankruptcy lawyers today to schedule your free consultation and take the first step toward financial freedom.

Sources:

[1] Bankruptcy Filings Drop 6.3 Percent. (2023, February 6). United States Courts. https://www.uscourts.gov/news/2023/02/06/bankruptcy-filings-drop-63-percent

[2] Bankruptcy Data & Statistics (Updated September 5, 2023). (n.d.). BankruptcyWatch. https://www.bankruptcywatch.com

Received Accolades:

206-2010, 2012, 2014-2021

American Bankruptcy Institute

Certified as a Bankruptcy Specialist by ABC

National Association of Consumer Bankruptcy Attorneys

Better Business Bureau

Office Location

30800 Van Dyke Ave

Warren, MI 48093

Monday – Friday : 9:00 am – 5:00 pm

Saturdays : 9:30am – 11:30 by phone only

In office appointments as late as 6:30 on Wednesday. We offer over phone late night appointments Mon-Thur